BECOMING A MEMBER OF RAM IS ONE OF THE BEST DECISIONS YOU CAN MAKE FOR YOUR BUSINESS.

By joining you gain access to exclusive, money saving discounts on services and programs, legislative updates and advocacy as well as valuable educational opportunities. We aim to help you grow and protect your business, promote the retail industry and save your business money. Click here to JOIN NOW!

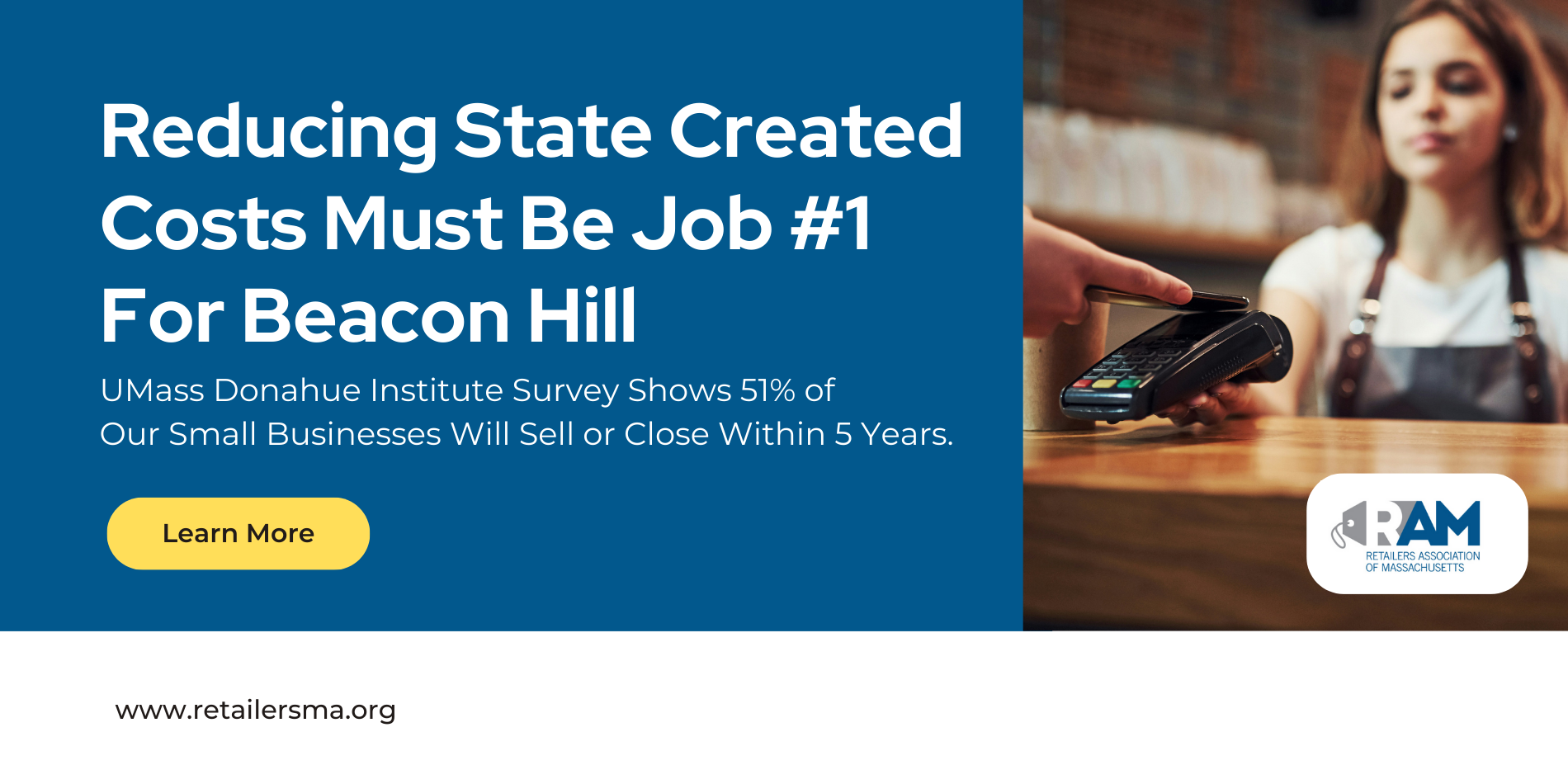

RAM Launches Advertising Campaign on Addressing High Costs In Massachusetts

It has been well documented that the high cost of living, and the high cost of doing business in the Commonwealth is hurting our economy and competitiveness. National census numbers have been clear that we are annually losing population to other lower cost states, and the additional dark storefronts of small stores and restaurants have continued six years past COVID.

It is imperative that our elected officials now look in the mirror and lower the costs of certain counterproductive state public policies which are hurting the disposable incomes of our working families, and therefore lowering sales on Main Streets. And those very same small businesses seeing lower customer sales are also injured in their costs of operations by the very same mandated costs affecting our consumers. Click here to keep reading this article.

RAM IN THE NEWS:

Boston Globe Op-Eds:

Click on Image below to

View Survey Results

By Jeffrey Gold, MD & Jon Hurst

April 2026 marks the 20th anniversary of the Massachusetts Health Care reform law, Chapter 58, which became the model for the Affordable Care Act. The goal of the law was to expand access to health insurance coverage for all residents, address uncompensated care and build transparency tools to better understand affordability.

While some may want to celebrate Chapter 58, many remain concerned about a health care system that is among the most expensive in the nation. Twenty years of paying for near universal health coverage is taking a toll on taxpayers, businesses and families. While Chapter 58 may have expanded government coverage and mandated subsidized insurance, it created a system that continues to saddle taxpayers and working families with escalating premiums, hospital bills, massive growth in non-profit hospital expansions and record-breaking drug prices that seemed unimaginable twenty years ago. Health care in Massachusetts is now unaffordable for families and small businesses. To keep reading this blog post, click here.

Small Businesses are drowning in hidden energy costs

Jon Hurst, RAM President & CEO, discussed Healthcare Costs with Sarah Iselin, President & CEO of Blue Cross Blue Shield of Massachusetts at the RAM Annual Meeting Awards Luncheon.

Click image above to read blog on healthcare costs.

RAMHIC Offerings for 2026

RAMHIC continues to partner with Blue Cross Blue Shield of Massachusetts to offer members access to the carrier's entire portfolio of high quality, small group health insurance plans.

All members purchasing their health insurance coverage through the cooperative will also receive an expanded list of ancillary benefits, FREE of charge.

Click image above to view a BCBS produced informational video on the power of the RAM/BCBS Cooperative.

Please see our brochure for more detail on the expanded benefit package. Specific information regarding each benefit may be found below:

For more information please visit the RAMHIC page of our website.

MA DOR Issues Emergency Regulation: Waiver of Penalties Due to Non-compliance with Advanced Payment of Sales Tax

As directed by Section 176 of Chapter 73 of the Acts of 2025, the MA Department of Revenue (DOR) has issued an emergency regulation outlining the process by which a taxpayer, facing an undue financial hardship, can apply for a waiver or abatement of penalties related to non-compliance with the advanced payment of sales tax requirements. The emergency regulation is here:

830 CMR 62C.16B.1: Advance Payments of Sales and Use Tax and Room Occupancy Excise (EMERGENCY REGULATION)

Members who have outstanding advance payment penalties are strongly encouraged to review the regulation to determine if it applies to your situation. Applicable tax types include sales and use tax, marijuana retail taxes, room occupancy excise, and local option sales tax on meals, due during the period between April 1, 2021 and March 1, 2026.

The regulation sets a criteria by which an “undue financial hardship” can be determined, and explains the process to apply through MassTaxConnect. The deadline to apply is by March 1, 2026.

RAM Applauds MA House Passage

of Energy Affordability Bill

Last week at the State House, the MA House of Representatives debated and passed H.5175, An Act relative to energy affordability, clean power and economic competitiveness, a significant bill to address energy affordability in the Commonwealth. The bill cuts $1 billion from the Mass Save program, a well-intentioned program but one that has ballooned over the years, funded by assessments on ratepayers, to become the primary tool in financing the state’s decarbonization efforts. The bill also returns 70% of alternative compliance payments (ACPs) to ratepayers over three years, expands clean energy procurement authority, and reduces barriers to possible future nuclear development.

House leadership estimated the reforms will save ratepayers roughly $3 billion in the coming years. RAM thanks and congratulates the House for their committed focus on energy affordability, noting that the bill directly confronts our energy affordability challenges and will lower costs for our small businesses, consumers, and families struggling with rising utility bills.

While more work lies ahead, last week’s action was a significant and important step forward. The bill now moves to the Senate.

MA Senate Advances Small Business

Unit Pricing Exemption Bill

In the Senate, RAM supported legislation was unanimously approved to update the state’s Unit Pricing small business exemption. S.2978, An Act updating the unit pricing exemption threshold, carves out gift cards and lottery products from the calculation of total gross sales, allowing more small operators to qualify for the exemption under the existing $5 million sales threshold. The bill also adds “motor fuels” to the exempt list as well, codifying in statute the existing exemption on gasoline, which currently relies on an “in-store sales” interpretation.

This action to update our unit pricing law’s small business exemption provides important cost relief to vital community partners – small, neighborhood markets and convenience stores. RAM applauds the Senate for their leadership on this issue. The bill now moves to the House.

REGISTER For Webinar to

Learn about RAM’s Retirement Plan Solution

Competition for talent in today’s marketplace has increased dramatically. Having strong benefits is the best way to attract and retain great employees. The federal government recognizes citizens have not saved nearly enough to produce a comfortable retirement and because of this shortfall, they’ve rolled out meaningful tax credits to help employers ease the burden of starting retirement savings

vehicles, like 401k’s.

RAM wants to help provide access to these benefits! We have rolled out a Multiple Employer 401k Plan to make offering a plan simple and painless as well as extremely cost effective. These types of plans have a number of unique benefits for employers including:

- Removing day-to-day administration

- Eliminate costly annual audit

- Outsource legal fiduciary responsibility to third parties

Like our workers compensation, health insurance, credit card and energy cooperative purchasing programs, our Multiple Employer Plan 401K plan is designed to save our members administrative costs, and to provide workforce recruitment and retention benefits to make you more competitive in our industry and in your community. Authorized under federal law, this plan is offered by state retail associations in more than 20 states, with RAM member participation leading all the states. Do yourself, your family, and your workforces a favor by learning more about this important member benefit

All considered, there has never been a better time to start a retirement plan!

Please join us on March 24 for a webinar to learn more about these tax credits and the advantages of our Multiple Employer 401k plan.

|